Unemployment vs Inflation

Unemployment and inflation are two economic determinants that indicate adverse economic conditions. Economic analysts use these rates or values to analyze the strength of an economy. It’s been found that these two terms are interrelated and under normal conditions have a negative relationship between two variables.

What is Unemployment

The unemployment rate is the percentage of employable people in a country’s workforce. The term employable refers to workers who are over the age of 16; they should have either lost their jobs or have unsuccessfully sought jobs in the last month and must be still actively seeking work. The formula used to calculate unemployment rate is:

Unemployment rate = number of unemployed persons / labor force.

If the unemployment rate is high, it shows that economy is underperforming or has a fallen GDP. If the unemployment rate is low, the economy is expanding. Unemployment rate sometimes changes according to the industry. Expansion of some industries creates new employment opportunities resulting in a drop in the unemployment rate of that industry. There are few types of unemployment.

Structural unemployment: the unemployment that occurs when changing markets or new technologies make the skills of certain workers obsolete.

Frictional unemployment: the unemployment that exists when the lack of information prevents workers and employers from becoming aware of each other. This is usually a side effect of the job-search process, and may increase when unemployment benefits are attractive.

Cyclical unemployment: type of unemployment that occurs when there is not enough aggregate demand in the economy to provide jobs for everyone who wants to work.

Employment is often people’s primary source of personal income. So employment impacts the consumer spending, standard of living and overall economic growth.

What is Inflation

Inflation can be defined simply as the rate of increase in prices for goods and services. We use different measures to calculate inflation. Currently, most used indicators are CPI (Consumer price index) and RPI (Retail price index). The following formula is used to calculate inflation.

Inflation rate = [(P2-P1) / P1] * 100

P1 = Price for the first time period (or the starting number)

P2 = Price for second time period (or the ending number)

There are two types of inflation:

Cost-push inflation: this occurs when there is a rise in the price of raw materials, higher taxes, etc.

Demand-pull inflation: this occurs when the economy grows quickly. Aggregate demand (AD) will be increasing faster than aggregate supply. Then automatically create the inflation.

Relationship Between Unemployment and Inflation

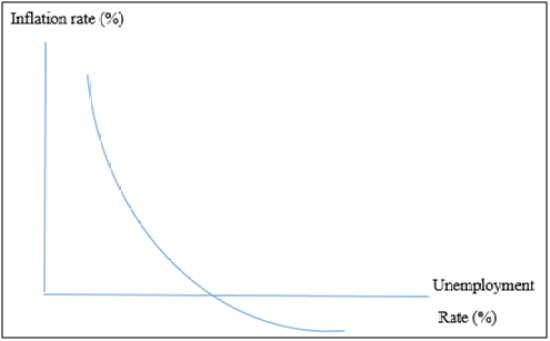

As mentioned above, the relationship between Unemployment and Inflation was initially introduced by A.W. Philips. Phillips curve demonstrates the relationship between the rate of inflation with the rate of unemployment in an inverse manner. If levels of unemployment decrease, inflation increases. The relationship is negative and not linear.

Graphically, when the unemployment rate is on the x-axis, and the inflation rate is on the y-axis, the short-run, Phillips curve takes an L-shape. It can be shown by a graph as below.

When unemployment rises, the inflation rate will possible to fall. This is because:

- If the unemployment rate of a country is high, the power of employees and unions will be low. Then, it is hard for them to demand their labor power and wages because employers can rent other workers instead of paying high wages. Thus, wage inflation is likely to be subdued during the period of rising unemployment. This will reduce the cost of production and reduce the price of goods and services. This causes a decrease in the demand pull inflation and cost push inflation.

- High unemployment is a reflection of the decline in economic output. thus, businesses experience an increase in increase in volume goods not sold and spare capacity. In a recession, businesses will experience a greater price competition. Therefore, a lower output will definitely reduce demand pull inflation in the economy.

Conclusion

Unemployment and inflation are two economic concepts widely used to measure the wealth of a particular economy. Unemployment is the total of country’s workforce who are employable but unemployed. On the other hand, inflation is the increase in prices of goods and services available in the market. There is a considerable relationship between unemployment and inflation. This relationship was first identified by A.W.Philips in 1958. Low unemployment rate and low inflation rate are ideal for the development of a country; then the economy would be considered stable.